How Has COP26 Impacted the Future of Investing?

Earlier this month, the COP26 climate change summit took place in Glasgow, where global leaders gathered to establish a plan to secure global net zero emissions, and try to keep temperature rises within 1.5 degrees – which scientists say is required to prevent a “climate catastrophe”.

The upshot of the summit was the signing of the Glasgow Climate Pact, a US-China cooperation agreement on clean energy, and agreements on cutting methane emissions as well as on stopping deforestation by 2030.

The private finance strategy of the global summit involved multilateral development banks and the private sector increasing their climate finance commitments. Under the leadership of former Bank of England Governor Mark Carney, banks, insurers, and pension funds with financial assets worth $130 trillion have signed up to 2050 net-zero goals agreeing to back “clean” technology, such as renewable energy, and by transitioning finance away from fossil fuel-burning industries.

Globally, investors are becoming increasingly mindful of the environmental impact of their investment decisions.

At the same time, there is increasing awareness of the role companies should be playing to look after their stakeholders and where possible to benefit society at large. This has translated into an increased interest on the part of investors in equity and corporate debt funds with socially responsible investment mandates.

What is portfolio alignment?

The UK government, in tandem with the Financial Conduct Authority’s initiative on disclosure and fund labelling, is aiming at ensuring that financial flows across the economy shift to align with the UK’s net zero commitment and wider environmental goals.

With portfolio alignment, investment funds will have to demonstrate their decarbonisation pathway and provide investors with transparent information that demonstrates whether their underlying holdings sits in line with the transition to new zero.

This disclosure will allow investors to make informed decisions and ensure that their portfolios are aligned with their lifestyle choices, interests, values, and opinions as regards investment planning.

How can you invest more responibly?

There are many options available to investors looking to align their investment portfolio with what they think is important to them in terms of personal values and priorities.

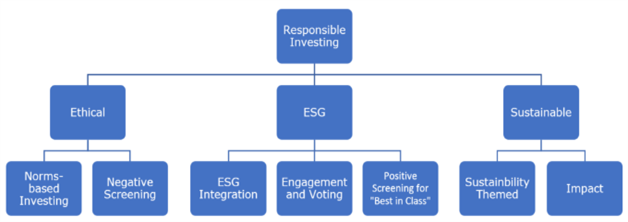

A summary of current mainstream investment approaches that could be subsumed under the heading of responsible investing can be visualised through the following scheme:

What Other Types of Insurance are There?

Watch our Q&A with Mike Fox, The Head of Sustainable Investments at the Royal London Asset Management to find out more about sustainable investing.

Are you interested in cleaner investment options? Find out more in our Q&A with Will Argent from Gravis Capital.

How can KLO Financial Services help?

At KLO Financial Services, our financial advisers – with the support of our in-house investment analyst – can offer specialist advice on the future of investing, including sustainable and ethical funds and the impact of COP26.

Want to understand how the transition to net zero will impact your investment plans?

Call 01926 492406 or email enquiries@klofinancialservices.com.

Disclaimer:

Any research is for information purposes only and does not constitute financial advice. The value of investments and any income from them may go down as well as up, so you may get back less than you invested. Past performance cannot be relied upon as a guide to future performance. KLO Financial Services Ltd are registered in the UK, company number 08711328. We are authorised and regulated by the Financial Conduct Authority, reference 710272.